On November 27, 2023, Scholz Group and Voestalpine held a strategic cooperation signing ceremony in Linz, Austria, and jointly signed a long-term cooperation framework agreement, marking a solid step for both parties to drive green steel production in Austria and its surrounding areas. The partnership aims to fully leverage the supply advantages of recycled steel raw materials of Scholz Group and support in Voestalpine’s “Greentec steel” strategy.

Scholz and Voestalpine signed a long-term cooperation framework to jointly support the green steel plan

Grand Opening of KOVOŠROT GROUP CZ YARD in PLZEŇ

On 5 October 2023 at 2.00 p.m., the opening ceremony of the main operation of Kovošrot Group CZ in Plzeň was held, attended by the Managing Directors and Directors of Kovošrot Group CZ facilities, including the CEO of the entire CHIHO Environmental Group, Mr. Henry Qin, and other distinguished guests.

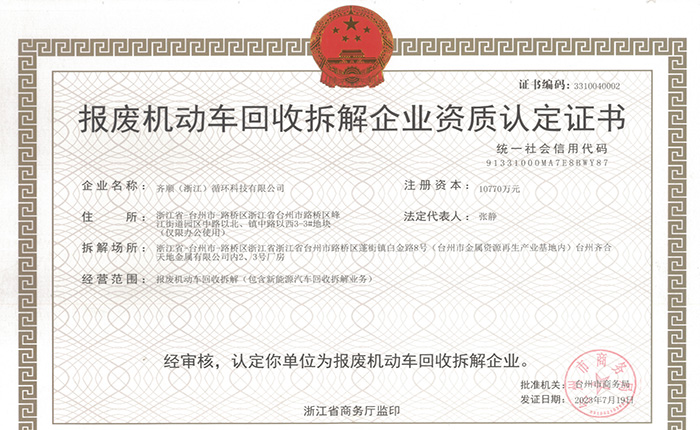

Taizhou Qishun Project was awarded with the qualification for ELV recycling and dismantling

On July 19th, Qishun (Zhejiang) Recycling Technology Co., Ltd. officially passed the assessment of Expert Group organized by the Zhejiang Provincial Department of Commerce and was successfully awarded with the Qualification Certificate for ELV Recycling and Dismantling.

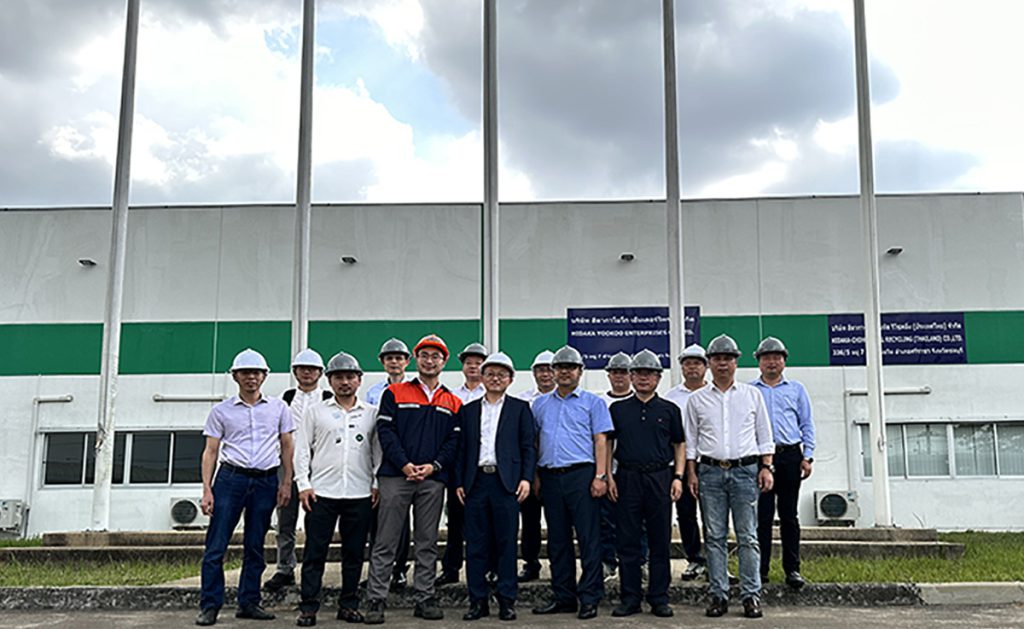

Miao Wenbin, Deputy Mayor of Taizhou City, Zhejiang Province, China, and his delegation visited the JV factory of Chiho Group

On March 20, 2023, Miao Wenbin, Deputy Mayor of Taizhou City, Zhejiang Province, China, visited the Hidaka-Chiho Metal Recycling JV factory of Chiho Environmental Group in Thailand for research and inspection.

Shandong HongShun Limited is rewarded the qualification of ELV recycling and dismantling

Shandong Hongshun Circular Economy Science and Technology Co., Ltd (hereinafter referred to as “Hongshun”) is officially rewarded the qualification of ELV recycling and dismantling by Department of Commerce of Shandong.

Qishun ELV comprehensive utilization project held the groundbreaking ceremony

On September 2, the key project of Qishun (Zhejiang) Recycling Technology Co., Ltd. — the End-of-Life vehicles (“ELV”) comprehensive utilization project (hereinafter referred to as the “project” or “Qishun project”) was officially kick off in Luqiao Economic Development Zone, Taizhou City, Zhejiang Province. Yang Jianfeng—director of the Management Committee of Taizhou Luqiao Economic Development Zone, Li Hui—deputy director of the management committee, Yao Jietian—executive director of Chiho environmental group, Qin Siji — general manager of Chiho Environmental Group Asia Pacific region, and representatives of Fujian Dongri Engineering Co., Ltd. and other relevant units attended the groundbreaking ceremony.

Chiho ECO Protection Limited was awarded the waste reduction commitment organization

Chiho Eco Protection Ltd., a subsidiary of Chiho environmental group in Hong Kong, was awarded the waste reduction commitment organization. The commitment to waste reduction was initiated by the Hong Kong environmental protection department in 2018, which aims to appeal to and encourage local enterprises to promote the implementation of innovative waste reduction measures, make people feel the sincerity of waste reduction in Hong Kong, and make the environmental protection atmosphere become the mainstream.

The Sino-German Hongshun Circular Industrial Park is creating a new flag for the world’s high-end recycling industry

Chiho will continue to use its well-established technologies and operational experience in the fields of

mixed metal recycling, non-ferrous metal recycling, and scrap vehicle dismantling and recycling, and

combine with its strong R&D capabilities to enable sustainable innovation for the Hongshun project.

Mr. Tu Jianhua as a member of CPPCC National Committee made suggestions for these development events at the two sessions

As a member of the 13th National Committee of the Chinese People’s Political Consultative Conference, Mr. Tu Jianhua, also chairman of the Chongqing Federation of Industry and Commerce and chairman of the board of directors of Loncin Holdings Co., Ltd (the shareholder of Chiho and Scholz), attended the Two Sessions in Beijing. He contributed ideas and suggestions on several topics, including the green transformation of the manufacturing industry in the context of China’s “dual carbon” goal, the high-standard development of the recycling industry, and elevating private enterprises.

Interview with Hong Kong Economic Times Global consensus to reduce carbon emission Optimistic about global demand on metal recycling

On November 16, Chiho ECO Protection Limited (“Chiho ECO”), a wholly owned subsidiary of Chiho Environmental Group (“Chiho Group”) in Hong Kong, was awarded the “Outstanding Contribution to Resource Recycling” by the "Hong Kong Economic Times" for its excellent contribution and performance in environmental, social and governance (“ESG”) matters.

Search

Categories

- No categories